Understanding Prefab Home Financing in India: Essential Insights for Buyers

Prefabricated homes are gaining popularity across India as an efficient and modern housing solution. These structures, built off-site and assembled on location, offer faster construction timelines and potentially lower costs compared to traditional brick-and-mortar houses. However, navigating the financing landscape for prefab homes requires understanding specific loan options, eligibility criteria, and documentation processes that differ from conventional home loans.

Prefabricated housing represents a significant shift in how Indians approach homeownership. As urbanization accelerates and housing demand increases, prefab homes provide a viable alternative that combines quality construction with time efficiency. Understanding the financial aspects of purchasing these homes is crucial for making informed decisions that align with your budget and long-term goals.

What Are Prefab Homes India for Sale and Their Market Availability

Prefab homes available in the Indian market range from basic modular units to sophisticated multi-story structures. These homes are manufactured in controlled factory environments using materials like steel, concrete panels, or engineered wood. The Indian prefab housing market includes various providers offering different designs, from compact studio units starting around 200 square feet to spacious family homes exceeding 2,000 square feet. Buyers can choose from ready-made designs or customize layouts according to their preferences. The availability varies by region, with greater options in metropolitan areas and industrial zones where logistics and transportation are more manageable.

Benefits of Prefab Homes India: Cost and Construction Advantages

Prefabricated construction offers several compelling advantages for Indian homebuyers. Construction time typically reduces by 40-60 percent compared to traditional methods, with most projects completing within 3-6 months. This time efficiency translates to lower labor costs and reduced financing charges during construction. Quality control improves significantly as components are manufactured in standardized conditions, minimizing weather-related delays and material wastage. Energy efficiency is another benefit, with many prefab homes incorporating better insulation and modern building techniques that reduce long-term utility expenses. Environmental impact decreases through reduced construction waste and more efficient material usage. Additionally, prefab homes can be dismantled and relocated if necessary, offering flexibility that permanent structures cannot provide.

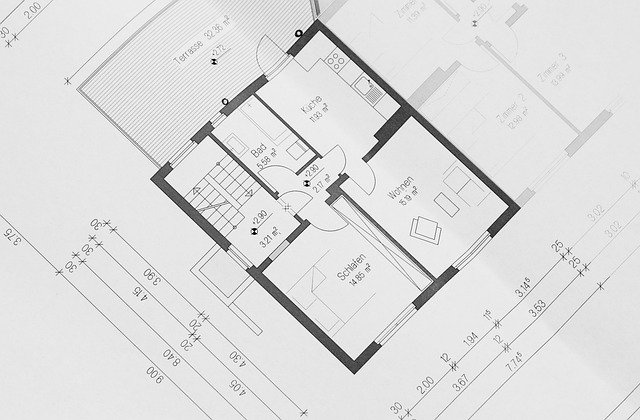

How to Build Prefab Homes India: The Construction Process Explained

Building a prefab home in India involves several distinct phases. First, buyers select a design and work with manufacturers to finalize specifications and customizations. Site preparation occurs simultaneously with factory production, including foundation work, utility connections, and necessary permits from local authorities. Manufacturing takes place in controlled facilities where wall panels, roof sections, and other components are precisely fabricated. Transportation logistics are then arranged to move components to the building site. On-site assembly typically requires 2-4 weeks, depending on home size and complexity. Professional installation teams use cranes and specialized equipment to position and secure modules. Final finishing work includes interior installations, painting, and connecting utilities. Throughout this process, quality inspections ensure compliance with building codes and safety standards.

Financing Options and Loan Structures for Prefab Housing

Securing financing for prefab homes requires understanding available loan products. Several Indian banks and housing finance companies now offer loans specifically for prefabricated construction, though availability varies by lender. These loans typically function similarly to conventional home loans but may have different documentation requirements. Some lenders classify prefab homes under construction loans, releasing funds in stages as building progresses. Interest rates generally range from 7.5 to 10 percent annually, depending on the borrower’s credit profile and loan amount. Loan-to-value ratios usually cap at 75-90 percent, requiring buyers to arrange 10-25 percent as down payment. Tenure options extend up to 20-30 years, similar to traditional home loans. Buyers should verify whether their chosen manufacturer and home design meet lender criteria before committing to purchase.

Documentation and Eligibility Requirements for Prefab Home Loans

Lenders require specific documentation when processing prefab home loan applications. Essential documents include proof of identity, address verification, income statements for the past 6-12 months, and bank statements. Property-related documents must demonstrate clear land ownership, approved building plans from local authorities, and detailed cost estimates from the prefab manufacturer. Some lenders request structural stability certificates and compliance documentation proving the home meets Indian building standards. Eligibility criteria typically include minimum age requirements of 21-23 years, stable employment or business income, and credit scores above 650-700. Self-employed applicants may need additional documentation including income tax returns and business registration certificates. The property must also meet minimum and maximum value thresholds set by individual lenders.

Real-World Cost Analysis and Provider Comparison

Understanding the financial commitment involved in prefab home ownership helps buyers plan effectively. Cost structures vary significantly based on materials, size, customization level, and location. Below is a comparison of typical prefab home providers and their cost estimations in the Indian market:

| Provider Type | Home Size Range | Cost Estimation (per sq ft) | Key Features |

|---|---|---|---|

| Basic Modular Units | 200-500 sq ft | ₹800-₹1,200 | Standard designs, minimal customization, quick assembly |

| Mid-Range Prefab | 500-1,000 sq ft | ₹1,200-₹1,800 | Moderate customization, better materials, energy-efficient options |

| Premium Prefab | 1,000-2,000 sq ft | ₹1,800-₹2,500 | Full customization, high-quality finishes, advanced features |

| Luxury Modular | 2,000+ sq ft | ₹2,500-₹3,500+ | Designer layouts, premium materials, smart home integration |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

These estimates typically include basic structural components but may exclude land costs, site preparation, foundation work, utility connections, and interior furnishings. Transportation costs vary based on distance from manufacturing facilities, potentially adding 5-15 percent to total expenses. Buyers should request detailed quotations that itemize all costs to avoid unexpected expenses during construction.

Tax Benefits and Government Incentives for Prefab Homeowners

Prefab homeowners in India can access various tax benefits similar to those available for traditional homes. Under Section 80C of the Income Tax Act, principal repayment on home loans qualifies for deductions up to ₹1.5 lakh annually. Interest paid on home loans is deductible under Section 24(b), with limits of ₹2 lakh per year for self-occupied properties. First-time homebuyers may claim additional deductions under Section 80EEA for properties valued below specified thresholds. Some state governments offer incentives for adopting sustainable and efficient construction methods, which may include reduced stamp duty or property tax concessions. Buyers should consult with tax professionals to understand applicable benefits and ensure proper documentation for claiming deductions.

Prefabricated housing offers Indian buyers an innovative path to homeownership with distinct financial and practical advantages. By understanding financing options, documentation requirements, and realistic cost expectations, prospective buyers can navigate the prefab home market confidently. Thorough research into lenders, manufacturers, and local regulations ensures a smooth purchasing experience and long-term satisfaction with this modern housing solution.